Retirement Security for All

Retirement Security for All

California is on the verge of a retirement crisis: With what is already one of the highest poverty rates among seniors in the nation, more than six million Californians have no access to a workplace retirement plan and are in danger of retiring to significantly diminished lifestyles. Nearly half of California’s working population is headed toward retirement into poverty.

What kind of communities will California have if millions of seniors are working themselves into the grave or are unable to support themselves? It could very well resemble the era before the passage of the Social Security Act when half of retirees were completely dependent upon relatives for basic survival and the indigent were consigned to government-run poor houses. So even young workers and families will struggle to provide for aging family members who have no retirement savings to fall back on.

CalSavers

Retirement Security for ALL Launched

CalSavers, the new retirement savings plan that will allow millions more Californians to retire with dignity, launched its pilot program and will begin enrollment in 2019. In 2016, Local 1000 sponsored SB 1234, the most ambitious push to expand retirement security since Social Security in the 1930s. Currently, less than half of private sector workers have access to a pension plan.

Fighting the growing retirement security crisis

Local 1000 is spearheading a coalition of labor, faith and social justice groups to expand programs that address the growing retirement crisis facing millions of Californians.

Last month, our union cohosted a coalition-building event that released research reviewing this growing crisis and what Californians will face at retirement age without new policies to change the future.

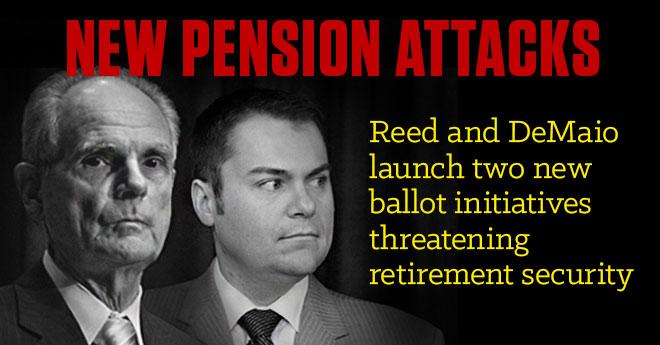

Pension attack fails, new threats launched

After a dangerous and deceptive pension initiative failed to gain support, right-wing extremists Chuck Reed and Carl DeMaio have come out with two new proposals that continue their efforts to degrade the hard-earned pension benefits of public employees.

While their new approach appears to dial back the threat to current workers, the new attacks are just as dangerous. Everyone who cares about the economic security of California as a large segment of our population moves toward retirement should take this multi-pronged attack very seriously.

Retirement Security for All Californians

Local 1000 member shares struggles as retirement board designs relief plan

The Local 1000-supported goal of creating a retirement safety net for Californians with no workplace plan came nearer its goal on September 28 as the Secure Choice Retirement board considered detailed information about how that state-run plan should work. Local 1000 was there to make sure our members’ voices are heard as important decisions are made on this groundbreaking program.

Pension attack takes next step

Attorney General releases official summary; signature gathering underway

The deadly 2016 pension-gutting ballot initiative designed to bypass collective bargaining and threaten the retirement security of all public employees has passed another milestone, receiving a official title and summary from California Attorney General Kamala Harris.

Titled the “Public Employees. Pension and Retiree Healthcare Benefits. Initiative Constitutional Amendment.” the ballot measure “eliminates constitutional protections for vested pension and retiree healthcare benefits for current public employees.”

Here is the official title and summary of the Reed/DeMaio Initiative

The Attorney General of California has prepared the following title and summary of the chief purpose and points of the proposed measure

PUBLIC EMPLOYEES. PENSION AND RETIREE HEALTHCARE BENEFITS. INITIATIVE CONSTITUTIONAL AMENDMENT.

Analyst says pension initiative would affect current employees’ compensation

LAO report warns of “significant uncertainty” in Reed/Demaio pension attack

According to a report released this week by the state’s Legislative Analyst’s Office (LAO), the pension-gutting ballot measure proposed by former San Jose Mayor Chuck Reed and former San Diego City Councilman Carl DeMaio is so drastic and recklessly conceived that it could lead to radical and unforeseen negative consequences.

Measure of Deception: CA Initiative Would Gut Retirement Benefits for Millions

When Democratic former San Jose mayor Chuck Reed and Republican ex-San Diego councilmember Carl DeMaio finally unveiled the language for a promised attempt at getting a statewide public pension cutting measure to 2016 voters, the expectation was that Reed II would be a reined-in and more realistically-framed version of Reed I – last year’s failed attempt at undermining the public pension system.

Deadly pension initiative bypasses collective bargaining

Hard-earned retirement, medical benefits under attack

A new ballot initiative filed last week to appear on the 2016 ballot, would bypass the collective bargaining table and effectively freeze retirement benefits for Local 1000-represented employees at the current contract level, requiring voter approval for any enhancement of those benefits.

Any alterations in cost of living adjustments, pension calculations, changes in vesting or lowering the age of retirement eligibility would all be subject to a statewide vote—even if they are successfully bargained in a contract.

New attack launched on public employee pensions

Ballot initiative threatens state worker retirement security

A coalition of anti-union, anti-public employee groups, including the National Right to Work Committee, launched their latest attack against public employee pensions and the hard-earned retirement security of state workers.

Their misleading campaign, called the “Voter Empowerment Act of 2016,” would undermine collective bargaining and require voter approval for changes to pensions and other retirement benefits, including medical insurance. The initiative will soon move into the signature-gathering phase and will appear on the ballot next year.

Local 1000 member lays out intergenerational challenges of retirement security in testimony before Secure Choice Retirement Board

Following are the comments of Local 1000 member Susan Difuntorum, an associate information systems analyst at DDS. She testified on May 26 at the Secure Choice Retirement Board, who is working to provide retirement options for the millions of Californians who don’t have employer-provided pensions.

Secure Choice board considers retirement plan options

Working to meet the needs of millions of workers with no pension

Local 1000’s work to provide retirement security for all Californians continued on April 27 as the California Secure Choice Board met to discuss the best options to help millions of private sector workers save for retirement.

“It is an incredibly complex job to create a savings system for workers, but it is extremely rewarding to know that our state is showing leadership in helping millions of workers gain retirement security,” Walker said.

Retirement Security Woes Affect Us All

Secure Choice Board moves forward on implementation

A Local 1000 member leader testifies about the retirement problems her family is facing even though they have a secure retirement through CalPERS.

Theresa Taylor, a longtime Local 1000 activist who was elected to the CalPERS board last year, told the California Secure Choice Retirement Savings Investment Board of her family’s struggles because her husband became disabled.

Stockton Bankruptcy Ruling Is a Win for Public Employee Pensions

On Thursday, Oct. 30, 2014, federal Bankruptcy Court Chief Judge Christopher Klein ruled in the City of Stockton case. One of the issues was whether public employees should be treated like any other creditor in bankruptcy. The good news is that Stockton city employee pensions are safe and the threat this case posed to public employee pensions everywhere has been averted.

Local 1000-endorsed Theresa Taylor wins CalPERS Board seat

Members voted to ensure retirement security and affordable health

care

Theresa Taylor, the Local 1000-endorsed candidate, has won a seat

on the CalPERS Board of Administration, earning 55 percent of the

votes counted — a nearly 20-point margin over the next opponent.

Lawmakers Look at State-Sponsored IRAs for Private-Sector Workers

California Senate President Pro Tem Kevin de Leon’s “second mother,” his Aunt Francisca, spent most of her 74-plus years cleaning houses for people who had pensions through their employers or were wealthy enough to set aside money in their own retirement accounts.

Aunt Francisca has neither, only Social Security. At an age when many people retire, she had to keep working until just recently, when she suffered a minor stroke. De Leon now helps support her.

Members build support for Secure Choice

Working to offer retirement dignity and security for millions

Local 1000 members are volunteering to be part of a campaign to build support for retirement security, including California’s Secure Choice program, which would offer options to more than six million California workers whose employers do not offer a retirement plan.

At a July 1 training session, more than 20 member activists learned about the retirement crisis and best practices for communicating about these issues with fellow state employees and community members.

Local 1000 stands with Wal-Mart employees

Standing up for better jobs in our communities

Wal-Mart is the largest employer in the US – they rake in billion-dollar profits while failing to pay a living wage to its workers. We’re taking part in a strike rally in Rancho Cordova today at 3:00 p.m. as part of our fight to end poverty wages and our economy’s race to the bottom. Join us today at 10655 Folsom Boulevard.

Local 1000 endorses Theresa Taylor for CalPERS board

Long-time activist is committed to retirement security

Longtime Local 1000 DLC 786 president Theresa Taylor, who has been active in every major Local 1000 campaign in the past decade, has announced her candidacy for an open seat on the CalPERS Board of Administration.

Fighting for better jobs in our communities

Members help low wage workers organize

Local 1000 members advanced our fight to grow the middle class and protect all workers from the race to the bottom by participating in a global wave of strikes and protests on May 15 in 150 cities across the US and 33 additional countries on six continents.”As someone who cares about where our economy is headed and what kind jobs are being created in my neighborhood–this is my fight,” said Beth Snyder, a steward at the Department of State Hospitals who attended actions in Sacramento.